We recognize it's a personal decision. There are many reasons to consider it.

There are several reasons why someone might choose to sell their mineral rights:

It's important to carefully consider your specific circumstances and consult with legal, financial, and real estate professionals before making a decision to sell your mineral rights. Additionally, seek advice on how selling may impact your overall financial and estate planning goals.

Expedition is happy to make recommendations to point you in the right direction.

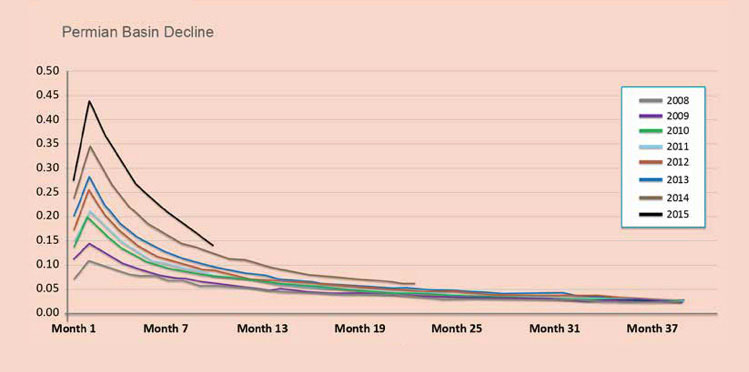

Production typically declines over time. Even if there are expectations of future royalties, there is no guarantee that the mineral resources will continue to be economically viable. The rate of decline in production can be unpredictable, and it's possible that future royalties may not match initial expectations. Selling the rights ensures a fixed payout regardless of future production.

Market Timing: Timing can be crucial in the mineral rights market. Owners may choose to sell when market conditions are favorable, such as when mineral prices are high or when there is strong demand for rights in their area. This can lead to a more attractive sale price, making it a compelling choice for those concerned about future royalties.

Yes, you can sell a portion of your mineral rights while retaining some ownership to preserve a legacy or maintain an interest in the mineral resources beneath your land. This approach is often referred to as a "partial mineral rights sale" or a "fractional interest sale." It allows you to monetize a portion of your mineral rights while retaining control or benefitting from a percentage of the royalties generated from the extracted minerals.

Here's how it typically works:

Preserving a legacy through a partial mineral rights sale can be a practical way to generate income or liquidity while ensuring that future generations or heirs have some connection to the land and its resources. It allows you to strike a balance between monetizing assets and retaining an interest in the mineral wealth of your property. However, it's crucial to consult with legal and financial professionals experienced in mineral rights transactions to navigate the complex legal, financial, and contractual aspects of such sales effectively.

Not necessarily. Each seller needs to talk to his or her own tax advisor, of course, to understand tax impact and the difference between ordinary income and capital gains. It’s possible that you will have tax advantages by receiving a lump sum capital gain, rather than royalty income.

We are happy to provide you a list of CPAs in Big Spring or Midland who can advise on this “lump sum versus royalty income” issue and how it might apply to your individual situation.

Unfortunately, and despite what you may hear elsewhere, there is no simple or do-it-yourself formula we can provide on our website for you to plug in numbers and get "the value."

Key factors we take into account when evaluating a property include location of the asset, drilling activity in the surrounding area, the operator who owns the lease on the property, and estimated timing of any future production.

If you are interested in hearing more details, our knowledgeable team would be pleased to walk you through our process, step by step.

Evaluating the value of mineral rights requires specialized knowledge. Our proprietary process enables us to project future production from a lease, serving as the basis for determining the present-day value. The accuracy of our modeling and the excellence of our data sources allow us to provide competitive prices for minerals. Nevertheless, it's important to recognize that, like any investment, there are inherent uncertainties and risks involved in predicting the future.

If you’re currently receiving royalties, be aware that production typically declines, and your mineral resources will naturally diminish over time. So, you need to project the value of your mineral resources into the future. We can help you do that and help you compare that value to the invested value of a current payout.

Expedition offers you swift evaluation and promptly funds your assets at the agreed-upon price.

We are committed to trustworthiness and transparency in all our dealings, ensuring you have a reliable partner throughout the process.

It’s not an uncommon situation. Expedition can accommodate your desire to work together with your group of sellers, or independently.

Members of our team have bought and sold over 50,000 net mineral acres (NMA). We have seen and handled all the complexities that may be involved in mineral rights and royalty interest deals, including successfully addressing issues involving overriding royalty interests (ORRI) and non-participating royalty interest (NPRI). In the Permian Basin alone, we have handled over 800 individual transactions with landowners, including your neighbors.

No. We are primarily focused on Howard and Martin counties in the Permian Basin, but we are also involved in transactions throughout the United States. You may be a landowner with properties in multiple states. We have the financial strength and the experience to evaluate your properties, and we will be interested in speaking with you about any of your properties.

Once we submit our offer, with supporting facts, in an offer letter, the next step is to answer any questions you have. The offer letter contains the full terms of a sale – purchase price, effective date, closing date, and Expedition’s responsibilities.

After that, if the offer is accepted, we will create the necessary documents to close the deal, and we will subsequently handle any closing costs, recording fees, etc.

Another advantage of working with Expedition is that we have already completed title verification – a mineral rights title search - to confirm your ownership. This allows us to make an accurate offer from day 1 and be prepared to close as soon as you are ready to move forward.

Closing is the last step! Once the deed is in place, Expedition will promptly fund the transaction, straight to the account of your choice.